Speed and simplicity aren’t all you’ll find with Biz2Credit. You’ll also obtain desire-only regular payments and a devoted funding professional to reply your questions and provide assistance all through the loan course of action.

What precisely is really an SBA loan? Dive into the small print of what SBA loans are and how one can apply for 1 these days.

Omega Funding Alternatives will not disclose its costs and/or desire for ERC loans, and that means you’ll need to get in contact For more info.

The next issues On this part make clear how you can take care of troubles with earnings tax returns if you:

Actually, companies can perform a lookback to find out when they meet the eligibility requirements. At the existing time, companies have until April fifteen, 2025, to file amended returns to the quarters in 2021 through which they have been eligible to assert the ERC.

Businesses who expert supply chain disruptions but didn't encounter an entire or partial suspension of functions by a qualifying purchase.

Most notably, the legislation would retroactively bar the submitting of any new/more ERC claims after January 31, 2024. You should check with an expert tax advisor with any ERC-similar inquiries or concerns.

Numerous taxpayers have submitted ERC statements and also have listened to practically nothing with the IRS. These taxpayers should really consider examining their tax transcripts with the IRS to make sure ERC refund checks or Denial Letters weren't shed during the mail or if not skipped. Assuming almost nothing was missed plus the IRS is actually nevertheless processing your amended payroll tax read more returns (Type 941-X), if six months have handed since you submitted the shape 941-X, you do have a statutory appropriate below Segment 7422 to file a federal suit in a federal district court docket of proficient jurisdiction (“District Courtroom”) or the Court docket of Federal Statements (“Claims Court docket”) to power the IRS to pay substantiated ERC refund promises. Right up until the IRS denies a taxpayer’s ERC refund, there is absolutely no statute of restrictions on some time for submitting fit beneath Segment 7422. In principle, it could be submitted many years from now, and curiosity would keep on to accrue in favor of any legit ERC refund (now the rate is 7%). However, as soon as the IRS formally denies the ERC refund claim, The 2-yr period of time begins, and also the taxpayer must file match inside this period of time unless an extension is granted (Variety 907). It is necessary to note that the executive appeals process (reviewed over) won't extend this two-12 months interval.

For the reason that a lender is purchasing out your ERC refund rather then you borrowing from your refund by using a bridge loan, you may steer clear of curiosity premiums and repayment durations this fashion.

There is absolutely no double-dipping for credits. Businesses who get the worker retention credit history can not acquire credit on those same experienced wages for compensated spouse and children health care go away.

Enterprises that have pending claims nevertheless can withdraw a submission In case the employer subsequently establishes they won't be suitable for the tax credit.

Board users or C-suite executives should signal validity agreements for nonprofits and international-owned entities

The IRS hasn't paid out your declare, or perhaps the IRS has paid out your declare however you haven’t cashed or deposited the refund Examine.

Also, it’s imperative that you understand that these loans do come at a rate. If you need speedy ERC funding, the charges and various fees may very well be worth it. Even so, if you don’t need to have resources within the in close proximity to future, you may want to take into account waiting for your refund so you're able to place more income into your pocket.

Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Tyra Banks Then & Now!

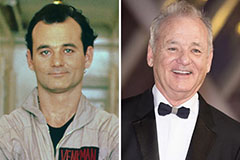

Tyra Banks Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!